What’s CBAM Regulation and how is it going to be applied to importers and exporters? Find out how this mechanism will transform global trade.

The European Union (EU) has been at the forefront of global efforts to combat climate change, and one of its most ambitious initiatives is the Carbon Border Adjustment Mechanism (CBAM).

Introduced as a cornerstone of the EU's Green Deal and the ambitious "Fit for 55" package—which aims to reduce net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels—the CBAM represents a transformative approach to international trade and environmental policy.

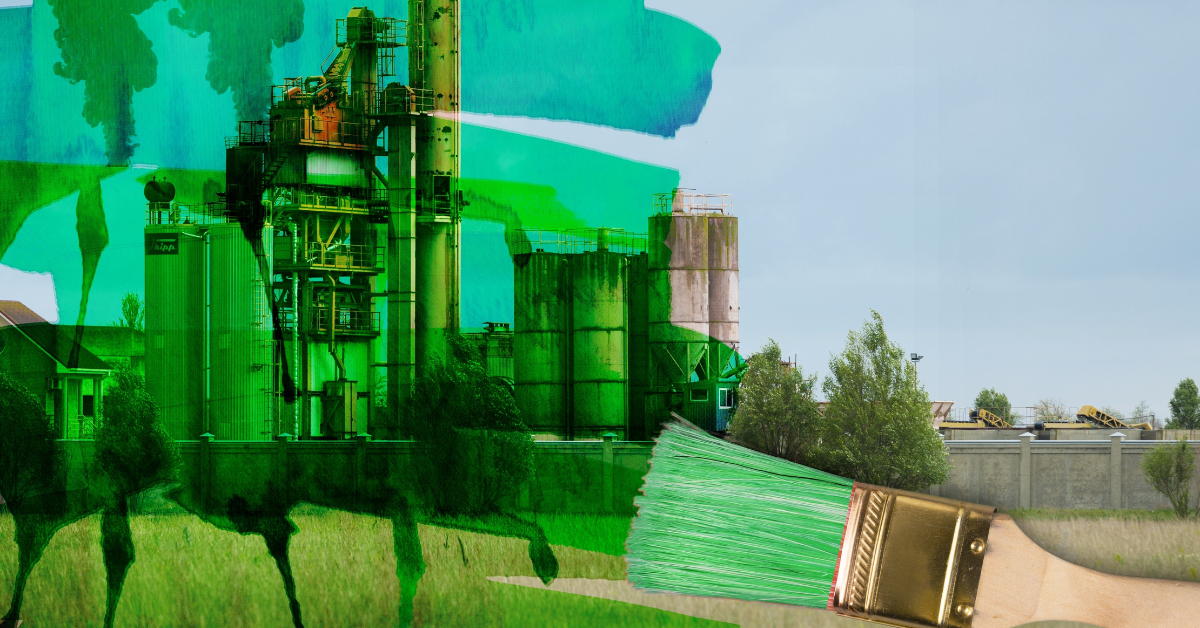

The mechanism is not just a regulatory tool; it's a strategic initiative designed to align economic activities with climate objectives on a global scale by addressing a critical issue known as carbon leakage, where companies might relocate production to countries with less stringent emission regulations, undermining global emission reduction efforts.

By levying charges on the carbon content of certain imported goods, the CBAM ensures that imports are held to the same environmental standards as products produced within the EU thus protecting EU industries from unfair competition and incentivizing other countries to adopt greener technologies and stricter climate policies.

In this context, understanding the CBAM is essential for businesses operating within the EU and international exporters to the EU alike.

Let’s try to give a clear picture of the Regulation.

Understanding the CBAM: Purpose and Scope

The CBAM is designed to address a significant challenge: ensuring that the EU's stringent climate policies do not put its industries at a competitive disadvantage compared to countries with less rigorous environmental regulations.

By imposing a carbon price on certain imports, the CBAM aims to equalize the cost of carbon between domestic products and imports, thereby preventing companies from relocating production to countries with lax climate policies and no carbon pricing.

Initially targeting high-emission sectors such as cement, iron and steel, aluminum, fertilizers, and electricity, the CBAM will require importers to purchase carbon certificates corresponding to the carbon price that would have been paid if the goods had been produced under the EU's carbon pricing rules.

The mechanism operates by requiring importers of carbon-intensive goods into the EU to purchase CBAM certificates.

Each certificate corresponds to the amount of carbon dioxide (CO2) emissions embedded in the production of the imported good with pricing directly linked to the cost of allowances under the EU ETS, which fluctuates based on market conditions.

Implementation Timeline and Compliance Requirements

The CBAM regulation entered a transitional phase started in October 2023, during which importers are obliged to report emissions embedded in their imports without yet paying a financial adjustment.

This phase allows businesses to adapt to the new reporting requirements and for the EU to fine-tune the system based on collected data.

During the transitional phase, the scope of CBAM will cover sectors with high carbon intensity, such as iron, steel, cement, fertilizers, aluminum, and electricity, with the possibility of expanding to other sectors in the future.

Full implementation is scheduled for 2026, when the financial adjustment mechanism becomes operational. Importers will need to declare annually the quantity of goods and the embedded emissions, surrendering the corresponding number of CBAM certificates.

The certificate’s price will be calculated based on the weekly average auction price of EU Emissions Trading System (ETS) allowances, expressed in euros per ton of CO₂ emitted.

Compliance with the CBAM will require companies to establish robust reporting and monitoring systems for greenhouse gas emissions across their supply chains, including direct and indirect emissions (Scope 1 and Scope 2 emissions) embedded in imported goods.

To ensure accuracy, businesses are encouraged to implement digital solutions for emissions tracking and monitoring, as well as to engage with their supply chains to gather precise data.

Finally, it is important to highlight that the EU has also outlined stringent verification processes starting from 2026 to ensure the credibility of reported data, including third-party verification, cooperation with non-EU countries on emissions standards, and potential penalties for non-compliance.

Conclusion

The CBAM represents a significant shift in how the EU addresses global carbon emissions, extending its environmental responsibilities beyond its borders.

Businesses operating within and exporting to the EU must stay informed and proactive in adapting to these regulatory changes.

As the CBAM moves from its transitional phase to full implementation, understanding its mechanisms and preparing accordingly will be essential for compliance and continued success in the global market.