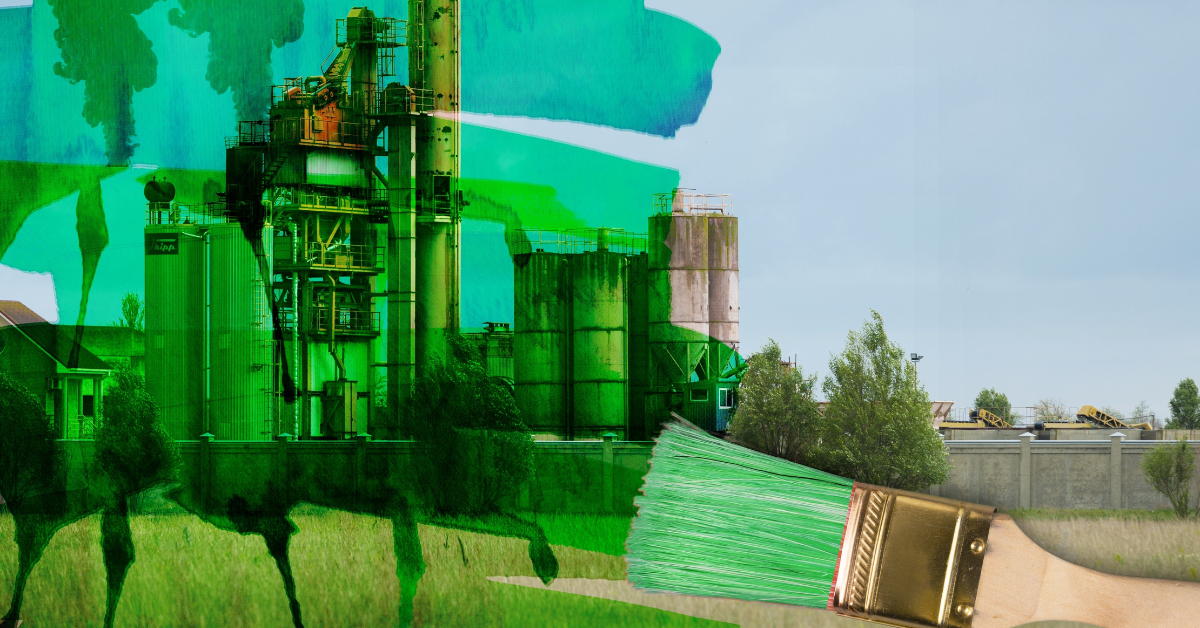

ESG criteria chart the course for sustainable transition in both the b2b world, from SMEs and large corporations to the world of finance.

The Rising Importance of ESG in B2B and Finance

In today's business landscape, Environmental, Social, and Governance (ESG) criteria are no longer just buzzwords; they are becoming essential benchmarks for success. Whether you're a small to medium-sized enterprise (SME), a large corporation, or a financial institution, the integration of ESG principles into your business operations is critical. Companies that prioritize ESG not only enhance their reputation and compliance but also unlock better financing opportunities, increase investor trust, and ultimately drive more sustainable and profitable growth.

The Challenge of Monitoring and Demonstrating ESG Value

As ESG becomes a vital part of business strategy, a key challenge emerges: How do companies effectively monitor their ESG performance and demonstrate its value? The need for robust ESG planning and reporting is clear, but the path to achieving it can be complex. Companies must navigate various tools, methodologies, and frameworks to accurately assess and report on their ESG impact, particularly within their supply chains.

No matter the industry, the sustainability of the supply chain is a critical factor in a company's overall ESG performance. Supply chains today are at a pivotal juncture, with the potential to become more agile, digitally connected, and sustainable. This transition is not just about meeting regulatory requirements—it's about aligning with consumer expectations and achieving long-term business resilience.

The Visibility Gap in Supply Chain Sustainability

However, the reality is stark: While many companies discuss their sustainability efforts, they often address only a small fraction of their overall impact. A staggering 90% of a company’s carbon footprint typically comes from its supply chain. Yet, most companies lack the visibility and digital infrastructure needed to manage this effectively.

Deloitte's 2021 Global Chief Procurement Officer study highlights a significant barrier to achieving ESG goals: a lack of visibility. Only 18% of chief procurement officers reported actively monitoring their supply chain risks, and a mere 15% had full visibility into their supply chain processes. This gap in visibility hinders companies from making informed decisions and implementing meaningful changes that could reduce their environmental impact and improve social governance.

This lack of visibility also poses a threat to consumer trust. Today, 80% of consumers are willing to pay more for products that come from renewable sources and are produced under fair labor practices. Despite this, half of all companies still do not have a sustainability plan in place. Without a digitally connected supply chain, these companies are unable to collaborate effectively with suppliers and business partners to enhance sustainability.

Implementing Effective ESG Monitoring and Reporting

So, how can companies overcome these challenges and effectively monitor and demonstrate the value of ESG criteria? The answer lies in leveraging digital tools and platforms that provide comprehensive ESG assessment and reporting capabilities.

One such tool is Synesgy, a global digital platform designed to support companies of all sizes and sectors, as well as financial institutions, in assessing ESG sustainability across their supply chains. Synesgy offers a self-assessment feature that allows companies to evaluate their ESG performance and provides a suggested action plan to improve sustainability practices.

Charting a Course for Sustainable Success

Incorporating ESG criteria into your business strategy is essential for long-term success. As the demand for transparency and sustainability grows, companies must rise to the challenge by implementing effective ESG monitoring and reporting practices. By doing so, they not only enhance their reputation and compliance but also contribute to a more sustainable future for all.

Take the first step towards a more sustainable future with Synesgy. Assess your ESG performance today and discover how you can improve your supply chain sustainability to meet the demands of investors, consumers, and stakeholders. Don't let your company fall behind—embrace the future of sustainable business now.