Sustainability has become a key topic even for financial institutions, such as banks and insurance companies. Sustainability regulations, in fact, also require these entities to estimate and report risks related to ESG (Environmental, Social, and Governance) issues.

Just as for so many other companies, ESG assessment in banking and insurance companies must include both internal activities and, indirectly, those along their supply chains.

Assessing these risks requires, first and foremost, complete and accurate knowledge of the current situation. Achieving this level of knowledge can be difficult both for SMEs and financial entities.

Synesgy, through an innovative digital platform and an approach that combines standardization, localization, automation, and consulting, helps banks and insurance institutions meet this challenge.

ESG assessment, why is so crucial for banks and insurance companies

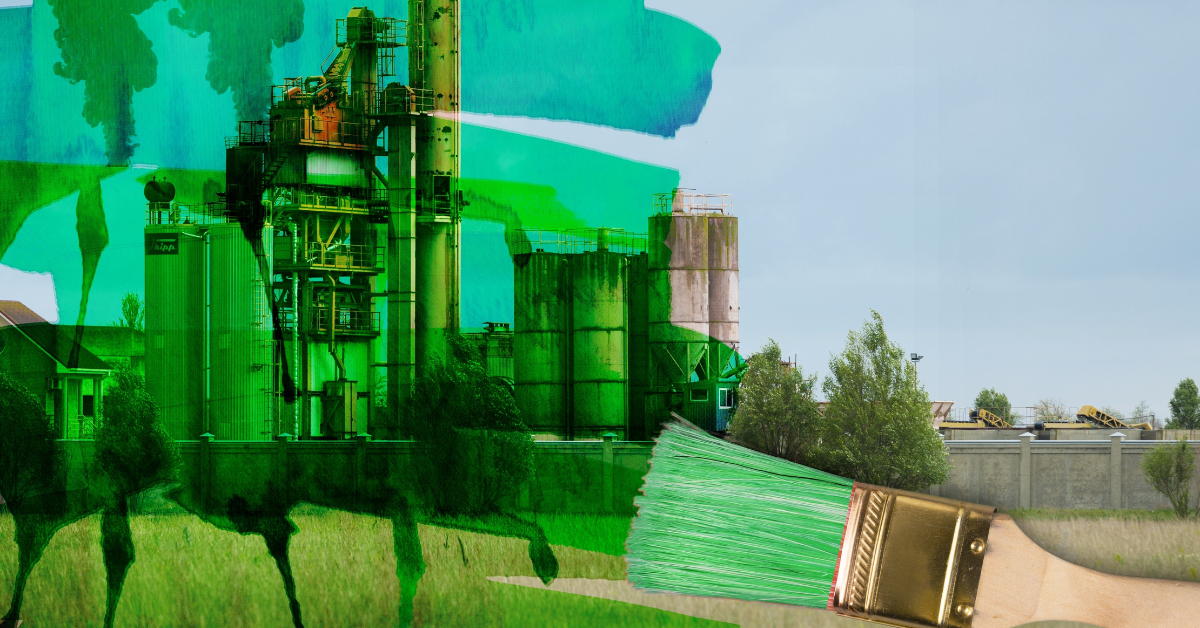

Banks and insurance institutions may be exposed to ESG risks directly through their own operations and indirectly through the services they provide to their clients, for example by financing or insuring clients in controversial industries or entities that are not attentive to sustainability criteria.

If not managed properly, these risks can negatively affect the organization's financial performance and credit, as well as its reputation.

Increasingly, legislators and regulators are pressing banks and other financial institutions to better manage and disclose these risks.

In fact, the Corporate Sustainability Reporting Directive (CSRD) has enlarged the obligation to disclose ESG performances to large companies which are “public interest entities” - such as banks and insurance organizations - with more than 250 employees, a turnover of more than 40 million euros or more than 20 million euros on the balance sheet.

It should also not be overlooked that banks and insurance institutions are often entities characterized by branches in different cities and often different countries. The ESG assessment must therefore also consider the special obligations arising from national legislation. And that is exactly what Synesgy offers, thanks to an approach that combines standardization with a local focus.

The path towards ESG assessment, in fact, starts with a questionnaire made of two sections: the first one with questions referring to the Global Reporting Initiative (GRI) and focusing on the Business side and the Environment, Social, and Governance principles. A second section focuses on the target industry's specific requirements and the country in which the company operates.

An intuitive ESG assessment for banks and insurance companies

The result of the process is an intuitive and in-depth ESG assessment, shown through Synesgy's dashboard. With a few clicks, it is possible to view both the overall score and the score for each of the other four sections: Social, Governance, Environmental, and Business.

A reliable and certified assessment: in fact, Synesgy questionnaires are based on internationally recognized ESG standards and certified data, both through an automated Alert system that notifies the Synesgy team when inconsistencies are detected in the information provided, and through the support of the company's team of consultants in investigating any discrepancies.

The advantages of ESG assessment for banks and insurance companies

The evaluation conducted by Synesgy helps banking and insurance organizations to meet the challenge related to ESG assessment and best practices on both the internal and external fronts.

In fact, the assessment and the report obtained at the end of the process help companies identify critical areas of the business, where action can be taken to improve their sustainability performance.

In addition, Synesgy's extensive database helps banks and insurers evaluate funding opportunities based on the ESG assessment of the questioned companies. With all these features, Synesgy also helps companies in these sectors reduce the complexities associated with ESG reporting.