They are defined as characteristics, or criteria, but also as aspects and risks: in these and other ways it is tried to give a definition to the three pillars of sustainability: Environmental, Social and Governance, in an acronym: "ESG."

ESG: the criteria that drive sustainable investments

They are defined as characteristics, or criteria, but also as aspects and risks: in these and other ways it is tried to give a definition to the three pillars of sustainability: Environmental, Social and Governance, in an acronym: "ESG."

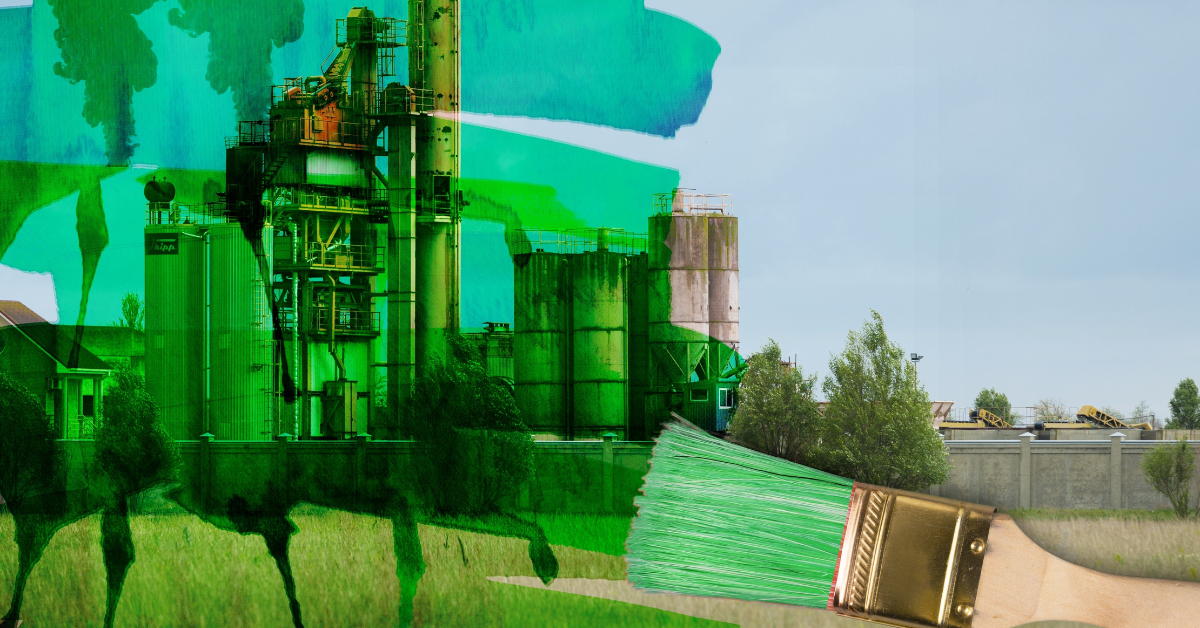

In the world of sustainable and traditional finance, ESG issues have been making their way since 2018, at first quietly and then with increasing acceleration, defining a new way of looking at economics and business.

If until a few years ago, in fact, business and related investments were looked at only in terms of profitability and risk, after the financial crisis of 2008, aspects related to business impact and its measurement became increasingly central.

An impact that precisely is reflected in the ESG meshes, correlating a multiplicity of issues, indicators and regulations, with the aim of making the activities of SMEs, corporations and the financial world increasingly aligned with the landscape of sustainable value created.

What ESG means?

Pillar E regarding Environment, is the most important without a shadow of a doubt, given the urgency of the issue and the challenging goals defined by the Paris Accords and set by the 2030 and 2050 Agenda, and to whose support institutions, public and private capital are being mobilized in order to veer toward a transitional economy.

To support such a decisive turning point for the European and global landscape, the European Union, which wants to place itself as a leader of change, has declined the environmental regulatory framework, as the first important legislation, i.e., the Taxonomy relating to Environment, from which other legislation consequently derives, and with it arises the continuously evolving framework, of ad hoc financial instruments to support the sustainable transition economy, as are the so-called "green mortgages," sustainable linked loans, green bonds and others.

The common commitment, of all the actors involved, is to reduce emissions by 55 percent by 2030 and reach the goal of climate neutrality in 2050, and to make this really happen, multiple initiatives in all fields: from sustainable construction, to zero-impact transport, to logistics, to the field of art and entertainment, to make the green economy change more and more concrete and outlined.

If the field of environment is currently more structured and defined, the second pillar S i.e. Social, is much more varied, especially because of the breadth of the issues covered and their related intangible component, of which there is still little definition about the measurement. Suffice it to think of social problems such as the integration of disadvantaged people or migrants into the social fabric of a city, which has to devise services adapted to meet the needs of a changing population, rather than issues about poverty and how to make independent and productive territories that are currently more critical, from the point of view of economic-social conditions.

It can be said that it will be in the social field that we will see the real results of the cultural change taking place, towards an economy of sustainability, and here too both public and private institutions are putting in place all the regulations, methodologies and financial instruments to support this.

The European Union is drafting the Social Taxonomy, now in draft form for approval, which is to be seen as complementary to the legislation introduced last February regarding the "Corporate Sustainable Due Diligence directive", where both aim to define the impacts of stakeholders' economic activities on the entire supply chain, thus contributing to the creation of shared value.

The taxonomic framework of the "S" pillar will be based on three macro-objectives: decent work, adequate standards of living and well-being of consumers and users of each economic good, and creation of sustainable and inclusive communities.

Moving on to the last letter, we find the elements of Governance, which although placed at the bottom of the ESG acronym, are considered the central and connecting point of sustainability issues.

This is because it is precisely from the governance of a company and an institution, that it is possible to build the foundation for suitable working, personal and social living conditions and that change can be imprinted with respect for the environment and the surrounding economic and social fabric.

Central themes in Governance and in the limelight, to support sustainable cultural change, are anti-corruption policies, equal payment between men and women, present of woman in company boards, work-life balance, rather than generational change within corporate and financial firms, which will have to secure themselves against the risk of leadership absence, which can go to the detriment of brand reputation.

It is precisely at the level of governance that the ESG strategy is established, which is increasingly integrated into the strategic growth plans of corporate companies and banks, thus proving to be the key node for developing business projects that incorporate Esg criteria into the corporate mission itself.

How to be ESG compliant?

The Esg filter thus turns out to be the engine of innovation toward sustainable transition, a framework without which it is no longer possible to think about doing investment activities in the real economy and in finance, and among the tools created to support cultural change is the Synesgy platform.

Synesgy is a digital platform for assessing the degree of sustainability of Corporate and SME companies and the financial sector (Banks and Insurance), which enables the measurement of sustainability performance according to ESG criteria.

The platform is the result of an alliance between CRIF SpA, Cribis Srl and a worldwide network of strategic partners, aimed at measuring through scoring the commitment of companies, banks and insurance companies and enabling monitoring, improving and reporting on the degree of ESG sustainability, responsibility and transparency of the parent company and the entire supply chain.

Thanks to a questionnaire that complies with international frameworks and regulations such as the UN 2030 Agenda, the 17 SDGs, GRI, and the EU Taxonomy, Synesgy supports the parent companies in the process of analyzing the sustainability performance of their Supply Chain, issuing at the end of the assessment a certificate with annual validity, to communicate the best ESG performance achieved.