Discover how ESG practices lead to business success and how ESG Performance impacts a company’s commercial risk and accountability.

As businesses worldwide navigate the complexities of modern markets, ESG performance has become a cornerstone for assessing organizations' health and future potential.

According to the insights provided by the Synesgy Global Observatory, ESG has evolved from being merely a tool for assessing environmental, social, and governance performance to becoming a comprehensive business framework. Companies that integrate ESG principles into their operations achieve measurable economic and reputational advantages, underscoring its role as a driver of sustainable growth and competitiveness.

Let’s take a look at the Report findings and discover the impacts of ESG Performance on company evaluation.

The Synesgy Global Observatory: A New Competitive Edge

The Synesgy Global Observatory offers a view of the global adoption of Environmental, Social, and Governance (ESG) practices, providing insights into how companies across industries and regions are integrating sustainability into their operations.

With data from over 500,000 companies in 144 countries, the Observatory underscores the transformative role of ESG in shaping business strategies. Thanks to an analysis that spans organizations of all sizes, from micro-enterprises to multinational corporations, the Observatory reveals the growing universality of sustainability as a key driver of success.

At the report’s core is the analysis of businesses' ESG performance, which goes beyond merely measuring metrics to demonstrate, through concrete data and evidence, how strong ESG performance translates into tangible commercial benefits.

By providing a structured evaluation of governance, environmental practices, and social impact, the evaluation of a business's ESG performance allows companies to identify strengths, uncover vulnerabilities, and align with stakeholder expectations.

The Strategic Role of ESG Metrics

Banks, insurers, and supply chain leaders increasingly rely on ESG assessment as a core component of their decision-making processes given its ability to provide critical insights into a company’s operations, governance, and environmental impact.

For financial institutions, these metrics help predict creditworthiness and operational resilience while, for supply chain managers, ESG scores are a proxy for supplier reliability and long-term stability.

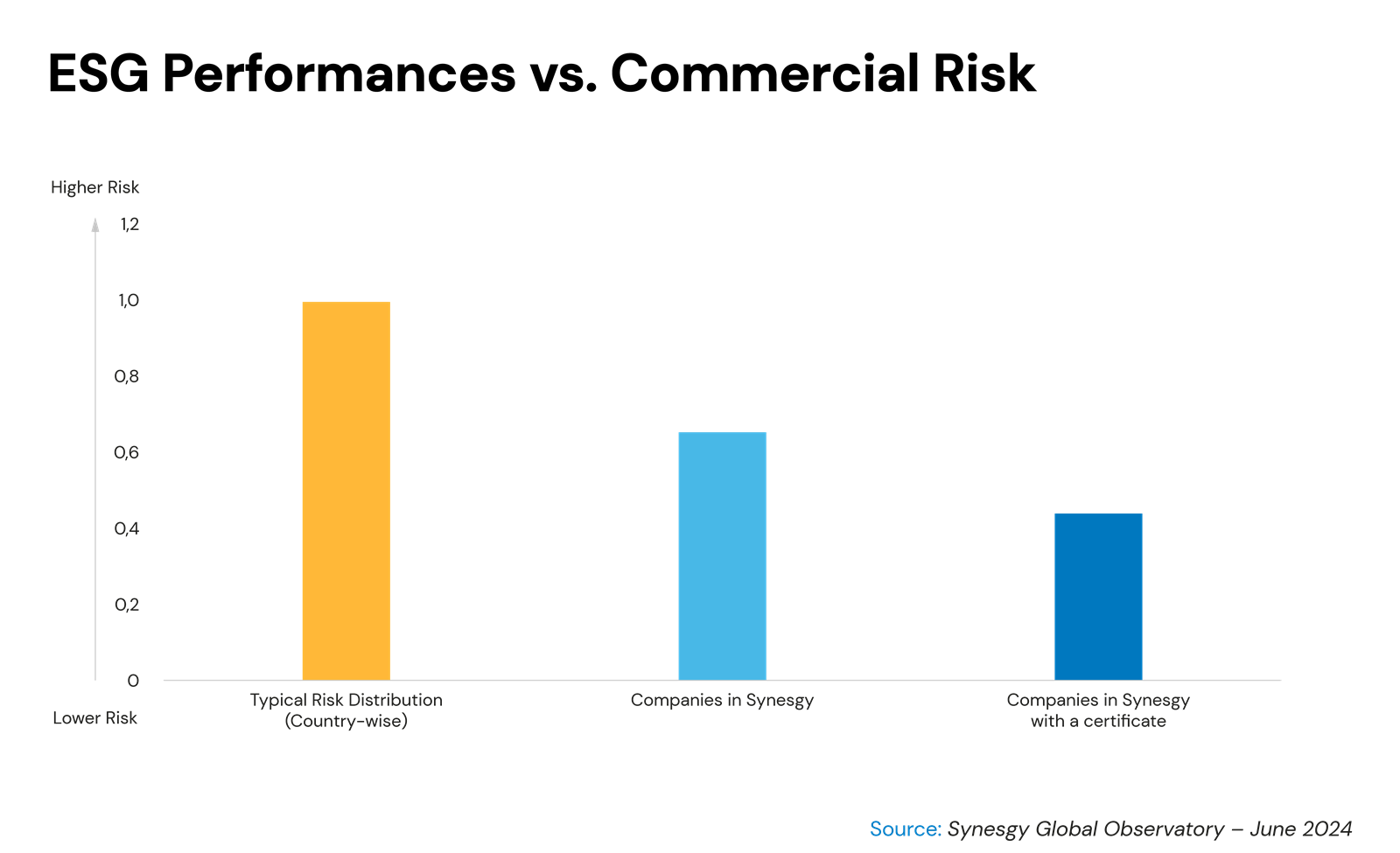

According to Synesgy data, businesses with higher ESG scores showed a 50% lower commercial risk compared to industry averages, establishing themselves as more reliable and attractive partners—an essential advantage in both selecting and being selected as a commercial partner.

The Financial Payoff of ESG

One of the standout findings in the report is the connection between ESG performance and financial advantages.

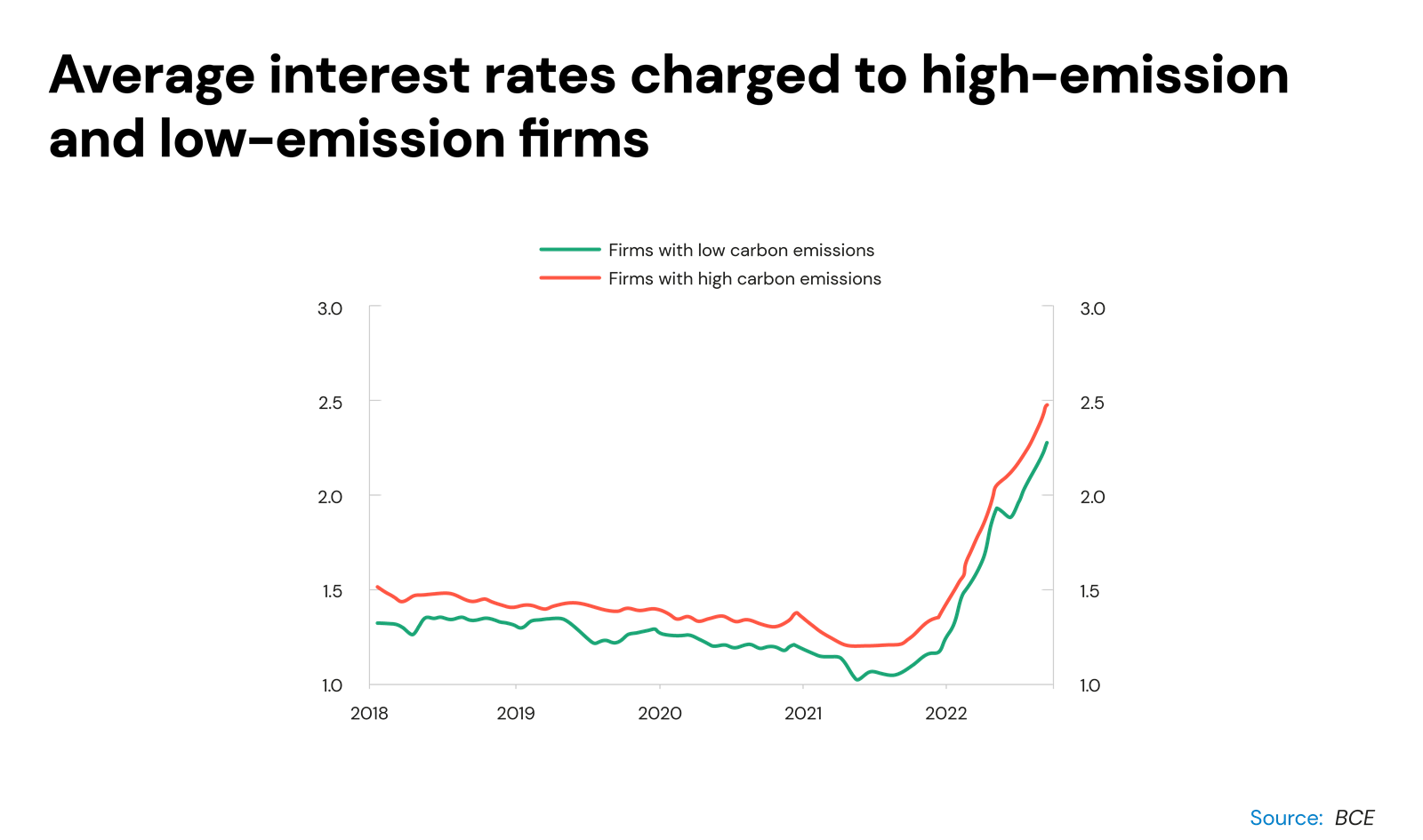

Companies with lower CO2 emissions consistently benefit from lower average interest rates and can access new funding opportunities.

Particularly, this reduced risk translates into more favourable credit evaluations of businesses from financial institutions.

European Central Bank’s data reveals that companies with low carbon emissions are more likely to secure financing under favourable terms, as lenders view them as better positioned to manage long-term challenges.

Additionally, these businesses show greater resilience during economic downturns, further solidifying their attractiveness to investors and banks.

Governance Scores and Timely Payments: A Key Indicator of Financial Discipline

Governance performance, as measured in the Synesgy ESG assessment, emerges as a crucial factor in a company’s financial discipline and its ability to maintain trust within its supply chain and with new potential business partners.

A key finding of the Synesgy Global Observatory is the relationship between a company's Governance (G) score, one of the key ESG components, and its payment behaviour.

Companies with higher governance scores (A and B levels) demonstrate a significantly greater likelihood of timely payment to their suppliers.

Specifically, companies with an "A" score show a 4% improved prompt payment rate compared to the average, while those with a "B" score outperform the average by 5.7%.

In contrast, companies with lower governance scores, such as "D" and "E," exhibit slower payment behaviours, lagging by 0.4% and 1.5%, respectively.

This correlation highlights how ESG scores, particularly the governance (G) score, can serve as a reliable indicator for corporate payment behaviours, making it especially valuable when selecting one business partner over another.

The future of ESG

The evidence is clear: ESG practices offer tangible benefits that extend beyond compliance.

From cost savings to market competitiveness, companies that embrace sustainability comply with regulations and secure long-term success.

For businesses looking to thrive in the 21st century, ESG is not just an option—it is a necessity.