In the new framework defined by the European Taxonomy, with regard to the rules and objectives for classifying business activities that are considered environmentally, socially, and governance sustainable, a prominent point much discussed at the moment, especially in the financial world, is covered by Article 8 of the Taxonomy.

Green Asset Ratio: what is it?

Specifically, the European Delegated Act 4987 of July 2021, defines and gives guidelines for the calculation of the Green Asset Ratio (GAR), i.e., the financial assets considered "green" and therefore in line with taxonomy activities, within the portfolio of a financial firm.

Building on the above-mentioned Delegated Act, the EBA transposed the enactment and detailed it in the binding standards for Pillar 3 disclosure on ESG risks, published in January 2022.

The Technical standards, contained in Pillar III on disclosure requirements, aim to ensure that stakeholders are well informed about financial institutions' ESG exposures, risks and strategies and can make informed decisions to exercise market discipline.

These standards propose information and KPIs or comparable indicators, including the Green Asset Ratio (GAR) and the less currently used Banking Book Taxonomy Alignment ratio (BTAR, which provides the same calculation methodology as GAR for firms without NFDR requirements), as a tool to show how institutions incorporate sustainability considerations into their risk management, business models, and strategy to set the path toward achieving the Paris Agreement goals.So the GAR is in a nutshell an indicator by which European financial institutions, primarily Banks, will have to report how much of their balance sheet is green or 'green'.

How to calculate the Green Asset Ratio

The GAR formula is nothing more than a fraction, composed as follows.

The numerator shows the proportion of assets on the balance sheet of financial institutions that are invested in 'green' economic activities and thus aligned with the European taxonomy. These include:

- Credits

- Bonds

- Equities

- Collaterals included on the basis of 'green' economic assets in the European Taxonomy, based on KPI indicators of both investment in fixed assets or Capex, and turnover of underlying assets.

Excluded from the numerator of the ratio, however, are:

- all financial-type assets held for trading purposes

- 'on-demand' interbank loans

- assets excluded from the scope provided by the Non-Financial Reporting Directive (NFRD), i.e., those loans to SMEs that are outside the scope of the NFRD and therefore do not publish information on their alignment with the European green taxonomy and for which, as mentioned above the BTAR will be calculated.

- non-EU exposures and also hedging derivatives.

The denominator of the Ratio, on the other hand, contains:

- the financial institution's total assets

- total loans

- total bonds and equities in the portfolio

- total collateral recovered, and

- the other assets on the balance sheet.

Note that included in both the numerator and denominator of the GAR are loans to local governments aimed at improving infrastructure and redeveloping urban areas, through interventions such as social housing, or greening public transportation and the like.

Instead, they should be excluded from both the numerator and denominator of the ratio:

- exposures to governments

- institutions

- central banks

- supranational issuers, and

- trading book assets.

Banks and other financial investment companies are called upon, therefore, to begin creating a solid information base for compiling the regulatory exercises useful for initiating the assessment and impacts of ESG risks and necessary for calculating the Green Asset Ratio and BTAR.

The benefits of the Green Asset Ratio for financial institutions.

The benefits of calculating and reporting the Green Asset Ratio are many for lending institutions and financial firms, and it is done through the reporting of taxonomy-aligned exposures that contribute to or fully enable climate change mitigation or adaptation.

First and foremost, it serves as a compass or dashboard to better manage taxonomy-related data streams and to report on them, measuring the performance of the companies in which one invests, giving greater visibility to business activities aligned with the taxonomy, enabling the definition of performance and investment strategies that are compatible with the European Union's environmental goals.

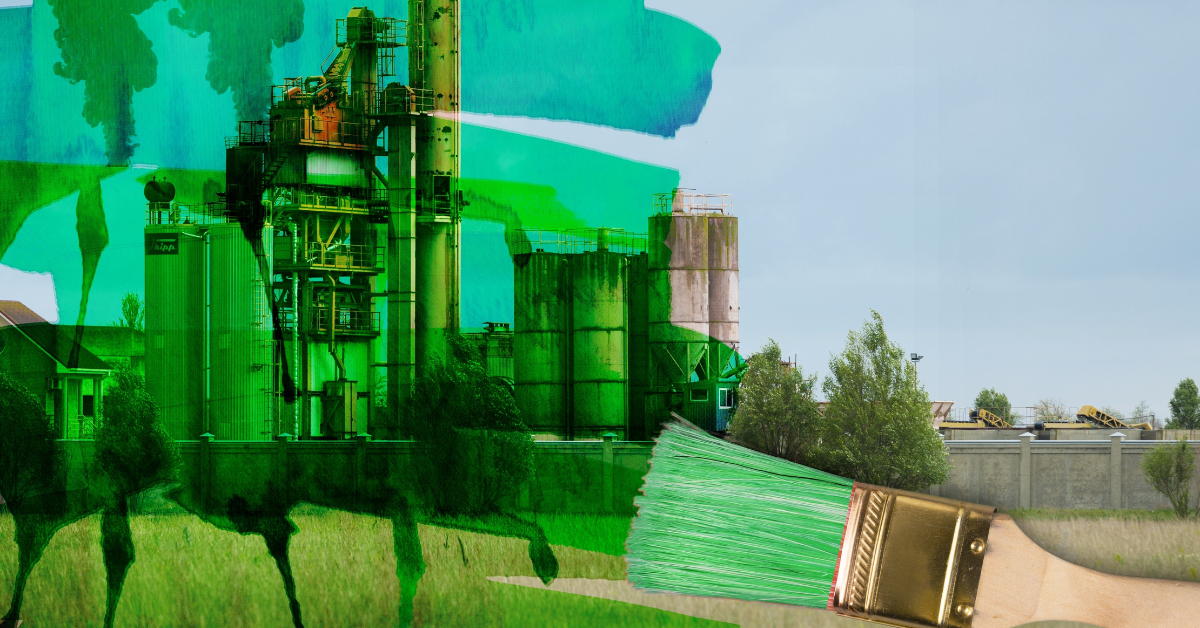

In addition, with the calculation of the GAR it is possible to increase the degree of accuracy, transparency and comparability of the data of both companies and financial institutions, mitigating the risk of greenwashing or other reputational risks related to the presence of litigation involving the environment.

The last point to highlight as an advantage, which remains the real goal of the European Taxonomy and is expressed in the method of calculation of the GAR and its communication, is to evaluate the environmental performance of portfolio companies in a homogeneous and rigorous way, giving greater visibility to the best performing and aligned with the EU Taxonomy, allowing a greater convoying of private investment capital flows, towards sustainable and innovative projects of the environmental pillar of the ESG criteria.