Sustainability is becoming more and more important for investors, consumers and regulators. The increased attention given to a businesses’ sustainable performances in recent years by all these stakeholders, as well as the relevant obligations (which are also affecting small businesses), have transformed sustainability from a “nice to have” factor to a leverage for competitiveness.

Indeed, a company's sustainability performance says a lot about the company itself: from the resilience of its business model to its corporate culture and, therefore, its ability to retain resources and attract new talents, which also affects the ability of the business to create innovation and evolve according to market’s needs.

Despite this, measuring and improving one's sustainability performance is a difficult path for many companies, especially small ones. This is because sustainability, as we recall, encompasses three dimensions: economic, social and environmental. Therefore, companies' sustainability strategies must examine these three aspects, which translate into many different lines of action within the company.

Sustainable performances, what are the regulatory obligations?

Why is it so important for companies to monitor their sustainability performance? In addition to improving the business model (e.g., in favour of sustainable growth over time and greater resilience), companies have to comply with a number of legal obligations to ensure that sustainability targets are met.

European policy in this area includes a number of measures to promote responsible business behaviour and to ensure the achievement of sustainability targets.

Corporate Sustainability Reporting Directive

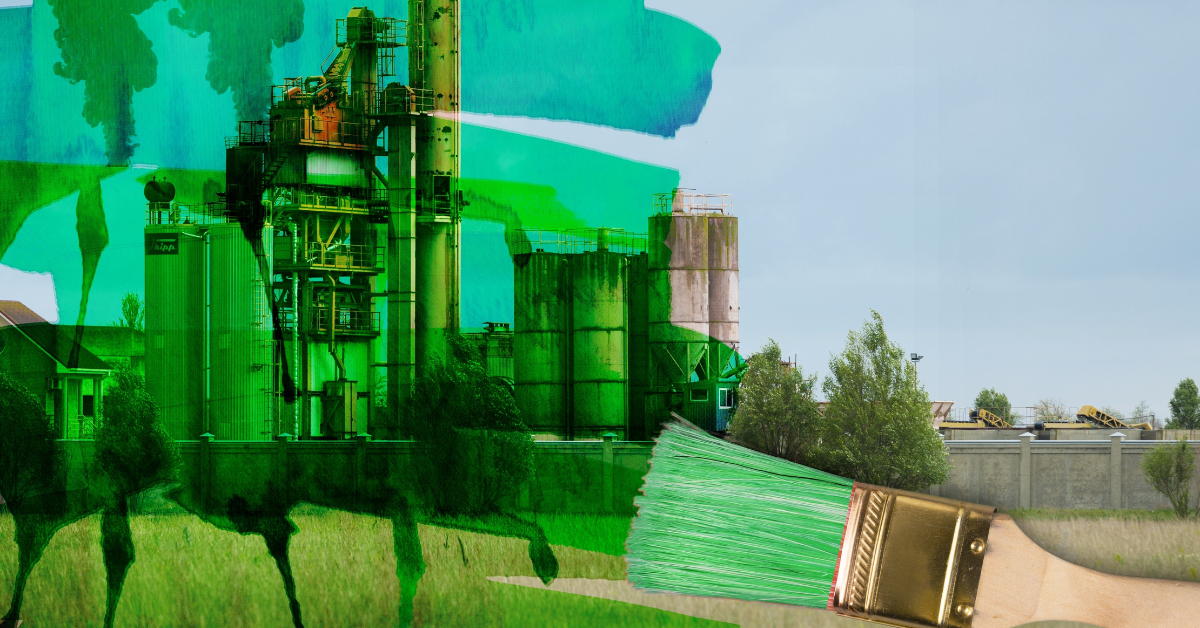

The Corporate Sustainability Reporting Directive (CSRD) was introduced in 2021 as a replacement for the European Non-Financial Reporting Directive (NFRD). The main objective of the CSRD is to accelerate the transition towards a sustainable economy and combat greenwashing practices.

It expands reporting obligations to 50,000 companies in Europe, requiring those with a minimum of 250 employees to disclose non-financial information starting from 2023. The CSRD also proposes extending reporting requirements to listed small and medium-sized enterprises (SMEs).

Complying with the CSRD involves focusing on governance and measurement, ensuring sustainability efforts are properly managed and tracking key performance indicators (KPIs).

The Corporate Sustainability Report includes various elements such as business model, strategy, policies, impacts, risks, and KPIs. Accurately identifying and tracking relevant KPIs is crucial for both measuring sustainability performance and fulfilling reporting requirements. Understanding the obligations and aligning with sustainability goals is vital in complying with the CSRD.

The Corporate Sustainability Due Diligence Directive

The Corporate Sustainability Due Diligence Directive (CSDDD) is an essential component of the European sustainability framework. Adopted in February 2022, it aims to promote sustainable and responsible corporate behaviour while incorporating human rights and environmental considerations into companies' operations and governance.

Under the directive, companies are obliged to identify, prevent, mitigate, and account for negative human rights and environmental impacts within their own operations, subsidiaries, and value chains.

The directive applies to large EU limited liability companies (Group 1) with 500+ employees and EUR 150 million+ in net turnover worldwide. It also includes other limited liability companies operating in defined high-impact sectors (Group 2) with more than 250 employees and a net turnover of EUR 40 million worldwide. Non-EU companies active in the EU are also subject to the directive. Although SMEs are not directly covered, they may be indirectly affected if they are part of the supply chain of a directive-compliant organization.

To comply with the corporate due diligence duty, companies must integrate due diligence into policies, identify and mitigate potential impacts, establish a complaints procedure, monitor effectiveness, and publicly communicate on due diligence. Additionally, Group 1 companies need to align their business strategy with limiting global warming to 1.5 °C in line with the Paris Agreement. The directive also introduces directors' duties to oversee due diligence implementation and integration into the corporate strategy.

The Carbon Border Adjustment Mechanism (C.B.A.M)

The Carbon Border Adjustment Mechanism (C.B.A.M) is a crucial instrument within the European policy framework aimed at accelerating the sustainable transition and promoting responsible business behaviour.

The main objective of the C.B.A.M is to prevent carbon emissions relocation and ensure that the carbon price of domestic products aligns with imports. This helps avoid undermining EU climate policies due to production shifting to countries with lower environmental standards or the substitution of EU products with higher carbon intensity imports.

The C.B.A.M encourages industries globally to adopt greener and more sustainable technologies. The first step of implementation, called “transitional phase” started on October 1, 2023. During this phase, it will apply to specific goods. Importers will be required to report import volumes and embedded greenhouse gas emissions without any financial adjustment. During this first phase, the functioning and scope of the C.B.A.M will undergo a review during the transitional phase, including the potential expansion to other goods produced in the ETS sectors.

The transitional phase allows for flexibility in reporting embedded emissions and the use of default values. Importers will need to purchase and surrender "C.B.A.M certificates" for embedded emissions starting from the definitive period in 2026.

The EU Taxonomy

The EU Taxonomy regulation is a crucial component of the EU's sustainable finance framework and serves as a market transparency tool. Its purpose is to provide companies and investors with a common language to identify activities that can be considered "sustainable."

This enables efforts and investments to be targeted towards activities that align with the EU's 2030 climate goals. The regulation, which came into effect on July 12th, 2020 aims to redirect capital towards sustainable investments, manage financial risks related to climate change and social issues, and promote transparency and long-term vision in financial and economic activities.

It provides criteria for financial market participants and advisers to determine whether an activity or product can be classified as "sustainable." These criteria include substantial contributions to environmental objectives, avoidance of significant harm to environmental objectives, compliance with minimum safeguards, and adherence to technical screening criteria established by the European Commission. The regulation outlines the necessary steps for an economic activity to make a substantial contribution or avoid significant harm to these objectives.

How to design a strategy to improve sustainable performances?

Measuring and monitoring: these are two key concepts for any company who wants to improve its sustainable performances, as it is not possible to improve something that it’s not measured.

The starting point must, therefore, necessarily be aimed at assessing the current situation, that is how the organization is positioned with respect to key sustainability indicators related to environmental, social and governance (ESG).

But where to start? International sustainability standards such as those of the Global Reporting Initiative (GRI) provide companies with a valuable guideline in identifying the KPIs most relevant to the individual organization. A sustainability strategy, precisely because of the many aspects and areas that this topic encompasses, needs to be tailored to the nature and objectives of the business to avoid wasting important resources.

This is why it is important to detect the material issues most relevant to the company, a process that starts with understanding the context in which the organization operates related to both its internal organization and the market in which it operates (and industry standards).

This process, which must also involve all stakeholders relevant to the company -shareholders, financial communities, employees, suppliers, business partners, customers, trade associations, public administrations, regulatory or supervisory bodies, the media, the territory and the population - allows to identify and assess the impacts of the company's operations, both potential and current.

From these results, the company can begin to identify areas for improvement, as well as its objectives.

Sustainable performances, how to measure them easily with an ESG solution

Although these standards provide a guide and a common language, for companies that want to measure and improve their sustainable performances, this process can be particularly complex, especially for those organizations that are not used to this type of analysis or that do not have the necessary knowledge of the initial situation, the most relevant KPIs and the areas where action needs to be taken.

This is why, in recent years, more and more companies are deciding to rely on ESG solutions that can automate and streamline this process. In fact, these solutions, based on a self-assessment – which considers KPIs specific to each macro-area of the business that impacts sustainability performance – allow to return a detailed and comprehensible snapshot of the company's sustainability performances, both at the general level and in the most important areas of the business.

This analysis makes it possible to identify the current situation, with relative strengths and weaknesses. From this visibility and knowledge the company can easily determine the goals toward which its sustainability strategy should be directed.

Assess, certify and improve: how to reach sustainable performances that matter

This analysis also makes it possible to certify company's sustainability performances. Certifying corporate sustainability performance is strategic for many organizations for several reasons, as:

- It is required by more and more large companies to be part of their supplychains;

- Good sustainability performance improves the brand reputations with customers, investors and employees (both current and potential);

- It opens up new funding and business opportunities for the company

However, it needs to be reminded that measuring the company’s sustainable performances is a continuous process, as performances will, indeed, improve or worsen over time. That is why a clear governance, accountability and specific sustainable KPIs are essential ingredients for a company's sustainability strategy. Equally important is the role of technology and consulting service providers working in this area, who can help the company avoid wasting resources and time.