Discover how blockchain technology enhances ESG transparency by enabling secure, tamper-proof, and efficient tracking of sustainability metrics.

In a sustainability-driven world, achieving ESG transparency is critical for organizations.

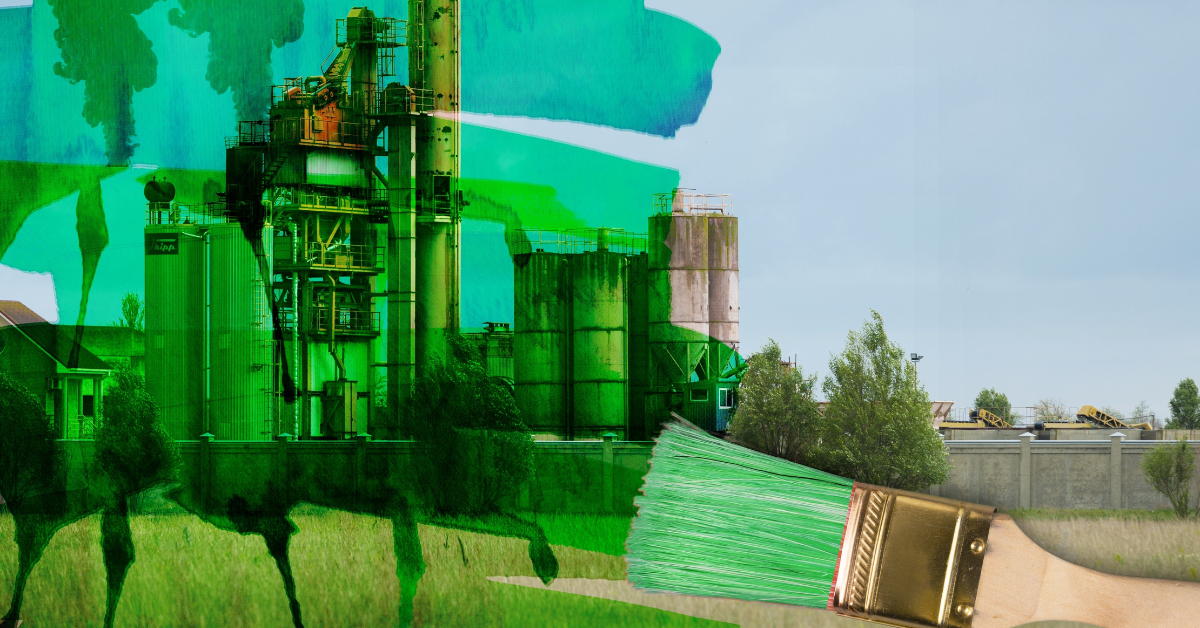

However, challenges like greenwashing, data inconsistency, and opaque processes in data management undermine trust in Environmental, Social, and Governance (ESG) data.

In this context, blockchain technology, with its decentralized and tamper-proof architecture, has emerged as an innovative solution to these persistent issues, transforming the way ESG data is tracked, validated, and shared.

What makes blockchain a leading technology for ESG transparency?

Let’s discover its characteristics and how organizations could benefit by leveraging it.

Blockchain technology: Characteristics and benefits

At its core, Blockchain serves as a decentralized and incorruptible ledger that ensures every piece of recorded data is both transparent and immutable.

Unlike traditional systems, where data can be altered or lost, blockchain creates a secure and permanent digital trail. This makes it an invaluable tool for addressing critical ESG challenges such as verifying sustainable sourcing in supply chains, preventing double-counting in carbon credit markets, and providing stakeholders with timely, accurate reporting and auditing.

With its ability to guarantee the integrity of ESG data, blockchain has become synonymous with the pursuit of ESG transparency, offering significant benefits for organizations including:

- Enhanced Trust: Immutable blockchain records build confidence among investors and stakeholders by ensuring the reliability of ESG data.

- Increased Efficiency: Automating ESG reporting minimizes administrative burdens, allowing organizations to focus on actionable sustainability efforts.

- Regulatory Compliance: Blockchain ensures comprehensive, transparent records, making it easier to meet evolving ESG regulations.

- Stakeholder Engagement: Transparent data on ESG efforts strengthens relationships with customers and partners who prioritize sustainability.

Challenges in Implementing Blockchain for ESG Transparency

Despite its promise, the adoption of blockchain technology for ESG transparency faces several challenges:

- Energy Consumption

Traditional blockchain models, such as those using proof-of-work (PoW), have a high energy demand, potentially conflicting with environmental goals. Transitioning to energy-efficient models like proof-of-stake (PoS) is essential to align blockchain with ESG values.

- Data Accuracy

Blockchain’s reliability hinges on the accuracy of input data. Ensuring high-quality data entry and verification mechanisms is critical for achieving true ESG transparency.

- Integration with Legacy Systems

Adopting blockchain requires alignment with existing data systems and ESG frameworks, which can be resource-intensive. Organizations need a phased approach to integrate blockchain into their ESG strategies effectively.

Practical Applications of Blockchain for ESG Transparency

Supply Chain Traceability

Blockchain enables real-time tracking of materials and products from their origin to their final destination ensuring ethical sourcing, reducing fraud, and verifies compliance with ESG standards.

For example, platforms like OpenSC use blockchain to certify the sustainability of food products, providing stakeholders with transparent, tamper-proof information about supply chain practices.

Carbon Credit Verification

Managing carbon credits is often plagued by issues like double-counting and fraud. Blockchain digitizes carbon credits as tokens, ensuring traceability and authenticity. Platforms such as DCarbonX simplify tracking, trading, and verifying carbon credits, which fosters accountability and boosts ESG transparency.

Automated ESG Reporting

Blockchain-based smart contracts automate ESG data collection, analysis, and reporting. This minimizes human error and accelerates reporting cycles.

Companies can use real-time dashboards powered by blockchain to share updates with investors, regulators, and other stakeholders, fostering trust and alignment with sustainability goals.

How to Leverage Blockchain for ESG Transparency

Organizations seeking to leverage blockchain for ESG transparency should focus on several key strategies.

Adopt Tailored Blockchain Platforms

The first step to leveraging blockchain is selecting platforms designed to meet specific ESG needs. Solutions like supply chain tracking systems or carbon credit verification platforms ensure blockchain's capabilities align with organizational priorities.

Focus on Data Quality

Blockchain’s reliability depends on the accuracy of the data entered into the system. Organizations must implement stringent data validation processes to ensure the integrity of their ESG metrics. Advanced IoT devices or third-party verifications can enhance data quality at the source.

Collaborate for Standardized Frameworks

To unlock the full potential of blockchain, organizations should collaborate with industry peers and regulatory bodies to establish consistent ESG reporting standards. A unified approach ensures that blockchain-based data is recognized and trusted across industries.

Educate Stakeholders

Internal teams and external partners must understand the benefits and functionalities of blockchain to embrace its adoption. Training programs and clear communication about blockchain's role in ESG transparency are critical for fostering collaboration and engagement.

Conclusion

Blockchain technology has the potential to revolutionize ESG transparency by providing secure, tamper-proof, and efficient data management.

While challenges like energy consumption, data accuracy, and system integration persist, they can be addressed through advancements in technology and strategic approaches to implementation.

As the demand for transparent and reliable ESG data grows, blockchain will offer a path forward, positioning businesses as leaders in sustainable and accountable practices.