Compared to SMEs, under Directive 2014/95/EU, large companies have several more pieces of information to publish related to environmental and social matters,treatment of employees and respect for human rights, anti-corruption and bribery diversity on company boards (in terms of age, gender, educational and professional background).

NFRD aims to deliver a comprehensive corporate reporting framework with qualitative and quantitative information to facilitate the assessment of companies’ sustainability impacts and risks.

Following a review of the NFRD consultation that closed in June 2020, the European Commission has issued a Corporate Sustainability Reporting Directive (CSRD) proposal on April 21st, 2021. The European Commission’s proposal extends the scope of NFRD requirements to include all large companies, whether they are listed or not, without the previous 500-employee threshold. This change broadens the scope of entities from 11,600 to 49,000 and means that all large companies are publicly accountable for their impact on people and the environment.

In addition to the EU Directive 2014/95 (Non Financial Reporting Directive) and the Corporate Sustainability Reporting Directive (CSRD) the sustainable finance framework includes another important disclosure tool, that is the EU Taxonomy.

A new proposal for a Corporate Sustainability Reporting Directive

On 21 April 2021, the Commission adopted a proposal for a Corporate Sustainability Reporting Directive (CSRD) which would amend the existing reporting requirements of the NFRD (, Non-Financial Reporting Directive).

The proposal:

- extends the scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises)

- requires the audit (assurance) of reported information

- introduces more detailed reporting requirements, and a requirement to report according to mandatory EU sustainability reporting standards

- requires companies to digitally ‘tag’ the reported information, so it is machine readable and feeds into the European single access point envisaged in the capital markets union action plan.

In addition, the Commission’s proposal envisages the adoption of EU sustainability reporting standards. The draft standards will be developed by the European Financial Reporting Advisory Group (EFRAG) and will be tailored to EU policies, while building on and contributing to international standardisation initiatives.

The first set of standards have been adopted by October 2022 and includes the following statements:

The role of EU Taxonomy

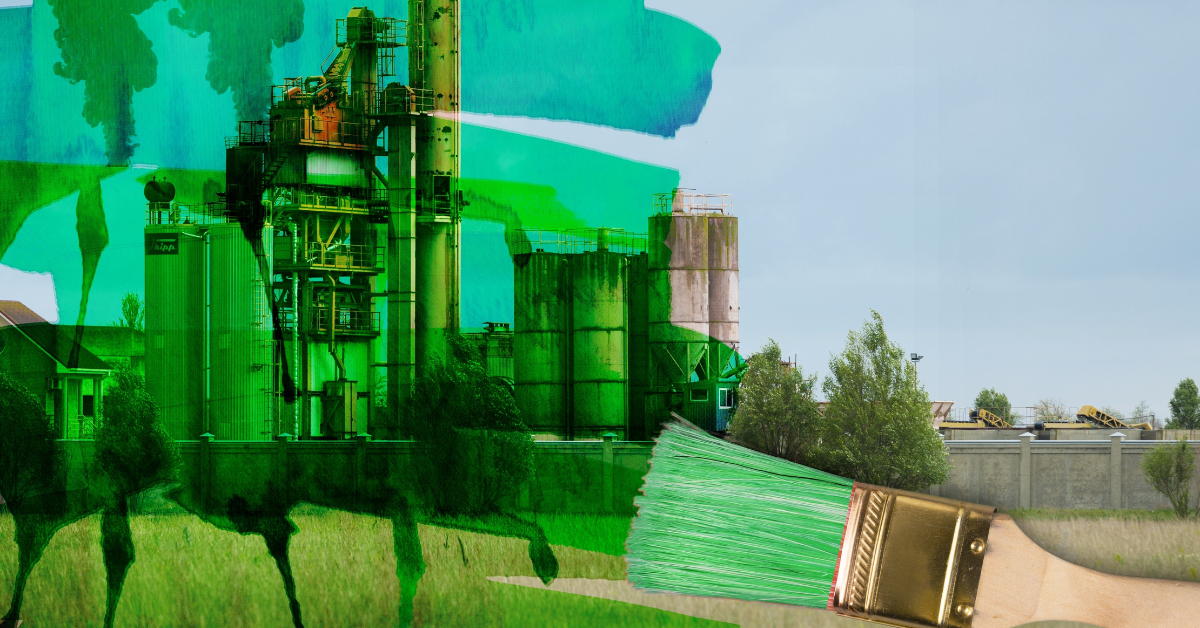

The EU Taxonomy can be described as a green classification system that translates EU climate and environmental goals into clear criteria to create a common language around green activities for specific economic activities for investment purposes.

The objectives set by the Eu Taxonomy are:

- The climate change mitigation

- The climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- The pollution Prevention and control

- The protection and restoration of biodiversity and ecosystems

The added value of the EU Taxonomy is that it can help scale up investment in green projects necessary to implement the European Green Deal.

Together with the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy will ensure that companies falling under the scope of the CSRD disclose their environmental performance information and their Taxonomy aligned economic activities.

This law applies from March 10th, 2021, and complements corporate disclosures by creating a comprehensive reporting framework for financial products and financial entities. Different investment strategies may entail investments in economic activities with different levels of environmental performance.

For this reason, the Sustainable Finance Disclosure Regulation (SFDR) distinguishes disclosure requirements for:

- Financial products that claim to have ‘sustainable investment’ as their objective (in environmental objectives) are often referred to as ‘dark green’ financial products).

- Financial products that claim to be promoting social or environmental characteristics (often referred to as ‘light green’ financial products).